The BBB cliff has been widely discussed and the growing number of recent “Fallen Angels” shows that a number of corporates are falling over the cliff edge.

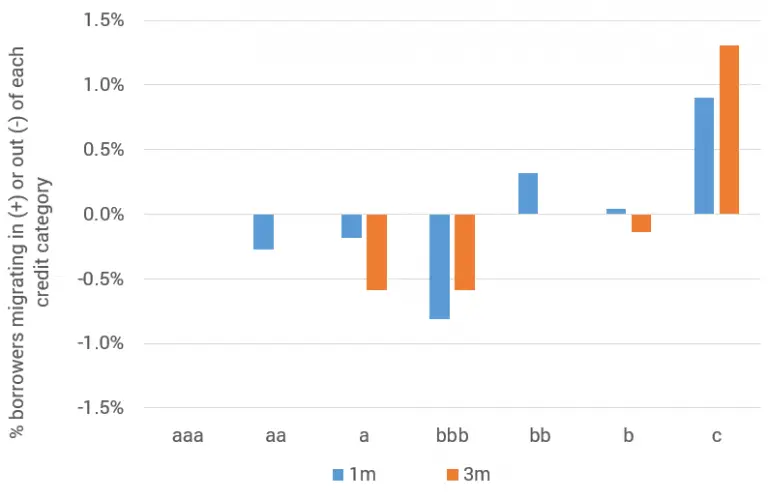

The chart below shows the recent pattern of US Corporate credit migration across the 7 main credit categories, for a sample of 2219 companies.

US Corporate Credit Migrations, Dec 2019 – Mar 2020

In the past three months, 0.5% of the sample has migrated out of the a category and a further 0.5% out of the bbb category. The c category accounted for just 1.9% of the overall sample at the end of 2019; it now represents 3.2%, an increase of nearly 70%. Most of this move occurred during March.

Between February and March, 0.25% of the sample moved out of the aa category, with a small additional movement from the a category. The movement out of bbb has accelerated, with about 0.8% of the sample migrating into the bb and c categories.

Further negative migrations are expected in coming months; the cumulative impact of these will push up the average expected default rate of the US Corporate sector.

Addressing the COVID-19 crisis, a recent paper by Professor Ed Altman** summarises predictions from various sources for High Yield borrower defaults in 2020. These range from 5% to 20% representing levels that in some cases have not been seen for decades. Defaults on this scale may occur as supply chains collapse while heavily indebted companies are unable to access Government rescue schemes.